Stories

When someone really understands the Village Savings and Loans methodology of saving money, taking loans, paying back and reinvesting profits and additional loans, they can incrementally increase their income over time in a very significant way. We find that the best way to explain what we do and why it works is to share success stories. There are so many impressive stories amongst those people we serve, but here are a few. We hope you will visit this page often, as new stories will be added.

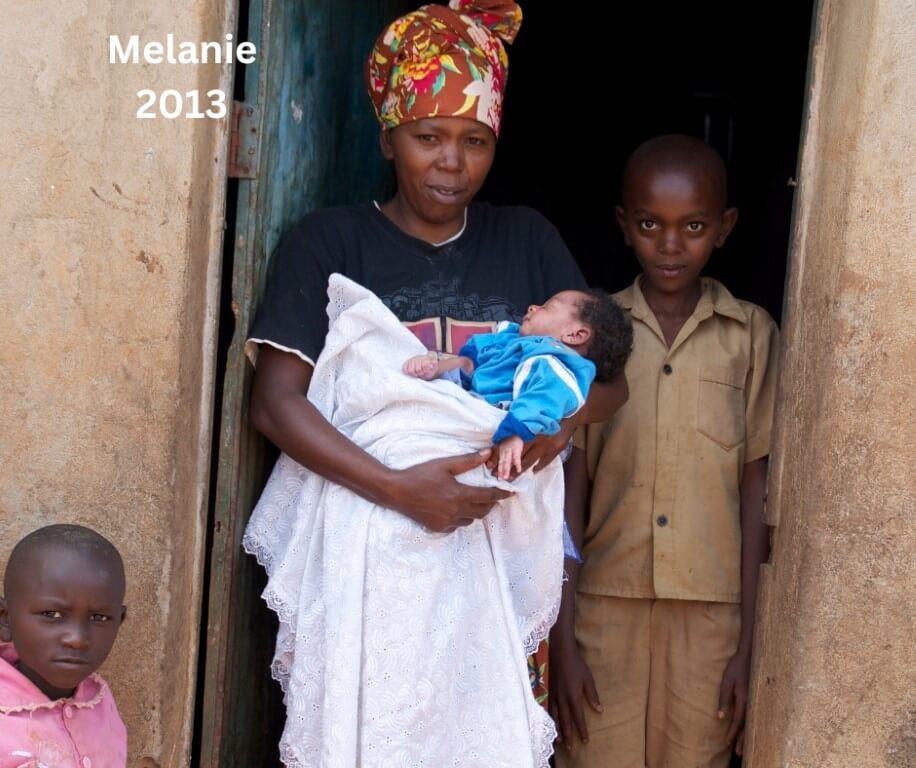

MELANIE

ILLUMINÉE

harriet

Harriet has a great story for a few reasons.

Firstly, the obvious piece is that her income went from earning $4 a week to earning $28 a week in just two years through her business selling maize flour, beans and peas. That allowed her to invest in 2 goats, a cow (that already produced a calf) and bought the land where her shop is located.

The second interesting thing is that Harriet said that now that she is earning good money, there is more peace in the home and her husband has given up seeing another woman. This is what we call unintended benefits. By facilitating financial stability in families, there are often many other positive outcomes that are not directly money related.

The third part of Harriet’s story of note is that when she first become a member of the Village Savings and Loans group, she didn’t quite understand the system and she took a loan to build her house. She had trouble paying back the loan, because the idea is to use loans in ways that generate income so you can then pay the loan back. Once she realized the difference and changed her strategy, she immediately started to see success.

NELSON

Nelson’s story is incredible. He used to be a subsistence farmer, earning about $135 per year. Over the past three years, he has used loans from his Savings and Loans group to plant a rice farm and used profits and loans to grow the farm and open a small shop. He is now earning around $1500 per year!

Nelson’s story is further proof that making funds accessible to Savings and Loans groups, allows members to do what they already know how to do, in order to support their families, but just didn’t have the means before. In this case, Nelson and his family had to leave their homes to live in camps during the years of conflict with the Lord’s Resistance Army. When they returned home, they had to start all over from nothing.

We are thrilled to be able to give that hand up to so many of those we serve in Northern Uganda who have lived through this trauma.

simparose

If you want to know why Simparose has a huge, infectious smile, it is because she is now earning about $37 a month from her 2 businesses selling second hand clothes and dried fish. In addition to that income, profits from those businesses allowed her to buy a cow that has, so far, produced 3 calfs which she sells for $175 each.

Before becoming a member of a Savings and Loans group and having the opportunity to have these businesses, she was only earning $80 per year! The smile says it all.

jasper

Jasper went from earning about $100 per year, as a subsistence farmer, to now earning about $40 per month from his shop that he opened using loans from his Savings and Loans group! In addition to that he earned more than $1000 growing soybeans last year.

He was able to purchase the land on which his shop stands, build a house, feed his family well and reliably pay school fees. He has accomplished all of this within just two years of being in a group! What will he accomplish in the next two years?

Lucy and patrick

Lucy and her husband Patrick have 6 kids and are both members of a Savings and Loans group. They also work together in all family businesses.

Before they joined the group 6 years ago, they were farming sunflowers and soybeans and earning about $135 per year. Using loans and profits, they opened a shop that sells food stuff and is now earning $13 per day. They also have a grinding mill that brings in $8 per day.

Through the success of their businesses, Lucy and Patrick now have 7 cows, 5 goats, 6 sheep and 2 pigs and they are able to afford school fees for a higher level of education than is offered in the village.

rose

Rose is the perfect example of how access to capital to incrementally build a sustainable income results in families whose next generations are living with a better quality of life than their parents did.

Rose has been a Village Savings and Loans group member for 5 years. During that period, she has taken loans that have enabled her to breed pigs, buy land, increase her cultivation of food crops and she has done this a few times over again. The pigs provide manure ,so she increased the output of crops. She also sells eggs from her chickens and ducks and because of all of her hard work and ability to get loans, she now owns, rather than rents her home.

On one plot of her land, her son built a house and grows maize. Her daughter also became a group member and is now living in Kigali, the closest city, and owns her own little food shop. That shop helped her to buy land back in the village that she rents out for additional income for the family.